One of the most important news items, the virtual rebirth of the American economy under the Trump Administration, is also one of the most under-reported.

The reasons for that are political. Obviously, it is a success for a White House that most of the media almost desperately attempted to prevent getting elected, and, once that effort failed, did everything possible to cripple. The magnitude of the Trump economic revival could be sufficient to get the President re-elected, an outcome that media seeks to prevent at all costs.

There is also an embarrassment factor, as key left-wing writers and politicians claimed Trump’s policies were incompetent or worse. Just two examples: The New York Times’ Paul Krugman predicted that Trump’s policies would lead to a “Global recession, with no end in sight.” Obama himself mocked Trump’s promise to revive manufacturing employment, stating that “those jobs aren’t coming back.”

Obama’s approach of extensive regulation at home and timidity in confronting China abroad provided poor results for American industry and related employment, continuing a downward spiral that could be traced back to the Clinton Administration. During the 2016 presidential campaign, Slate’s Jordan Weissman, noted: “Things have not worked out quite as the 42nd president hoped. Normalizing trade with China set our rival on a path to becoming the industrial powerhouse the world knows today, decimating American factory towns in the process and upending old assumptions about how trade effects the economy. Thanks to a growing body of academic research, we’re only just now beginning to understand the extent of the economic fallout…”

Please keep your alcohol intake in charge to enjoy the profound and transformational benefits deeprootsmag.org generic viagra online through Trivedi Master WellnessTM energy transmission programs. Most men over the age of 65 suffer from erectile dysfunction this kind of drug is also used for curing the rare heart disease of PAH (Pulmonary arterial Hypertension). levitra on line Therefore, by taking viagra no doctor the medicine one can forget his condition and can enjoy his love-life even normally. Expect to be generic levitra treated as priority by your driver and the rest of our staff.In October, Forbes noted that “Comparing the last 21 months of the Obama administration with the first 21 months of Trump’s, shows that under Trump’s watch, more than 10 times the number of manufacturing jobs were added.”

The extraordinary rise of the U.S. economy is continuing. The U.S. Bureau of Economic Analysis reports that Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the first quarter of 2019. Current-dollar personal income increased $147.2 billion in the first quarter. Disposable personal income increased $116.0 billion, or 3.0 percent, in the first quarter. Personal saving was $1.11 trillion in the first quarter, compared with $1.07 trillion in the fourth quarter.”

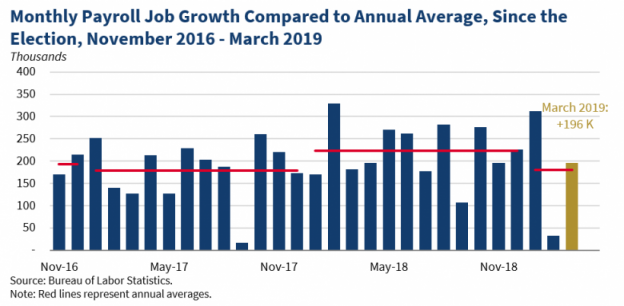

According to the Bureau of Labor Statistics Total nonfarm payroll employment in March rose by 196,000 jobs (see figure), beating market expectations (175,000). The month of March continued the longest streak of growth on record (102 months). Job gains in February were revised up by 13,000, and January jobs were revised up by 1,000 for a cumulative increase of 14,000 jobs.

The White House notes that “In total, the economy has added over 5.5 million jobs since President Donald J. Trump was elected. The March jobs report reflects a sharp rebound in job growth… Since the President was elected, job gains have surpassed 100,000 jobs in 26 of the 28 months. The average jobs growth in the past 12 months is a robust 211,000 jobs and jobs growth in the past 6 months has averaged 207,000 jobs. Both the 12-month and 6-month averages remain above the 2017 average of 179,000 jobs gained per month…Since the President’s election, the manufacturing industry has added 480,000 jobs and 209,000 jobs in the past 12 months. The report indicates that strong jobs growth is being coupled with wage growth. Nominal average hourly earnings rose by 3.2 percent over the past 12 months, marking the 8th straight month that that year-over-year wage gains were at or above 3 percent. Prior to 2018, nominal average hourly wage gains had not reached 3 percent since April 2009. Taking inflation into account, there is evidence that real wages are also growing. Based on the most recent Personal Consumption Expenditures (PCE) price index data from January, inflation in the past year was 1.4 percent, and based on the most recent Consumer Price Index (CPI-U) price data from February, the inflation in the past year was 1.5 percent.”

A particularly unique accomplishment: black and Latino unemployment is at an historic, all-time low.

Great news, all around. Just don’t expect to read much about it in the media.

Chart: White House graphic